Variable annuities are distributed by Prudential Annuities Distributors, Inc., Shelton, CT. Life Insurance and Annuities are issued by The Prudential Insurance Company of America, Pruco Life Insurance Company (in New York, by Pruco Life Insurance Company of New Jersey), located in Newark, NJ (main office), or by Prudential Annuities Life Assurance Corporation (except in NY) located in Shelton, CT. nor Assurance IQ issues, underwrites, or administers health plans or health insurance policies. ("Prudential") matches buyers with products such as life and health insurance and auto insurance, enabling them to make purchases online or through an agent. To read this article on click here.Assurance IQ, LLC a wholly-owned subsidiary of Prudential Financial, Inc.

When is the earnings report for chk free#

Click to get this free reportĬhesapeake Energy Corporation (CHK) : Free Stock Analysis Report

When is the earnings report for chk download#

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. We expect an in-line return from the stock in the next few months. Notably, Chesapeake has a Zacks Rank #3 (Hold). If you aren't focused on one strategy, this score is the one you should be interested in.Įstimates have been broadly trending downward for the stock, and the magnitude of these revisions indicates a downward shift. Overall, the stock has an aggregate VGM Score of A. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy. The consensus estimate has shifted -92.86% due to these changes.Ĭurrently, Chesapeake has a nice Growth Score of B, though it is lagging a lot on the Momentum Score front with an F. It turns out, estimates review have trended downward during the past month. How Have Estimates Been Moving Since Then? Notably, in 2020, the company is planning to invest capital in the range of $1,325 to $1,625 million.

Net long-term debt was $9,073 million, leading to a debt-to-capitalization ratio of 67.3%.Ĭhesapeake expects oil equivalent production for 2020 in the range of 161 to 173 MMBoE. Total capital expenditure increased to $487 million in the fourth quarter from $476 million in the year-ago quarter, primarily due to a rise in drilling and completion capital spending.Īt the end of the quarter under review, Chesapeake had a cash balance of $6 million. However, quarterly production expenses per Boe increased to $2.86 from $2.48 in the year-ago period. Total operating costs in the fourth quarter declined to $2,099 million from $2,375 million in the prior-year quarter. Average sales price of NGLs was recorded at $16.05 per barrel in the quarter compared with $25.11 a year ago.

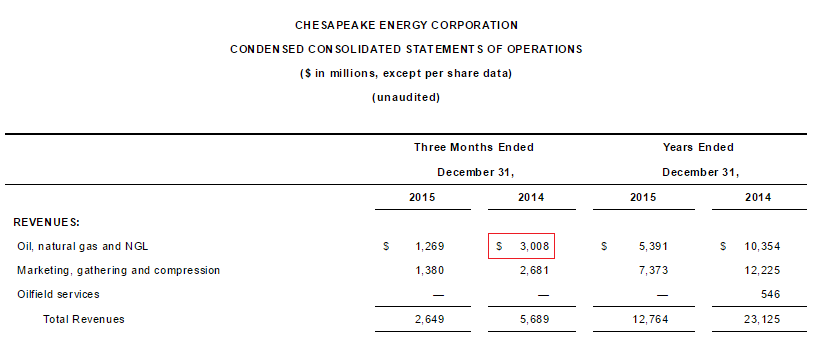

Moreover, natural gas prices declined to $2.24 per thousand cubic feet from the year-ago level of $3.59. Oil price was $57.48 per barrel, down from $62.98 in the year-ago quarter. Oil equivalent realized price - exclusive of gains (losses) on derivatives - was $25.17 per barrel, down from $29.64 a year ago. The total production comprised 12 million barrels (MMbbls) of oil (up 50% year over year), 178 billion cubic feet of natural gas (down 4%) and 3 MMbbls of natural gas liquids or NGLs (down 25%). Lower price realizations of commodities partially offset the positive.Ĭhesapeake’s production in the reported quarter was approximately 44 million barrels of oil equivalent (MMBoe), up from 43 MMBoe a year ago. The narrower-than-expected loss was a result of higher oil equivalent production. Moreover, the top-line missed the Zacks Consensus Estimate of $1,212 million. Operating revenues amounted to $969 million, down from $1,731 million in the year-ago quarter. However, in the year-ago quarter, the company had reported a profit of 3 cents. Chesapeake Energy Corporation reported fourth-quarter 2019 loss per share (excluding special items) of 4 cents, narrower than the Zacks Consensus Estimate of a loss of 6 cents.

0 kommentar(er)

0 kommentar(er)